Getting Home Insurance has never been easier

Home Insurance for North Carolina Homeowners

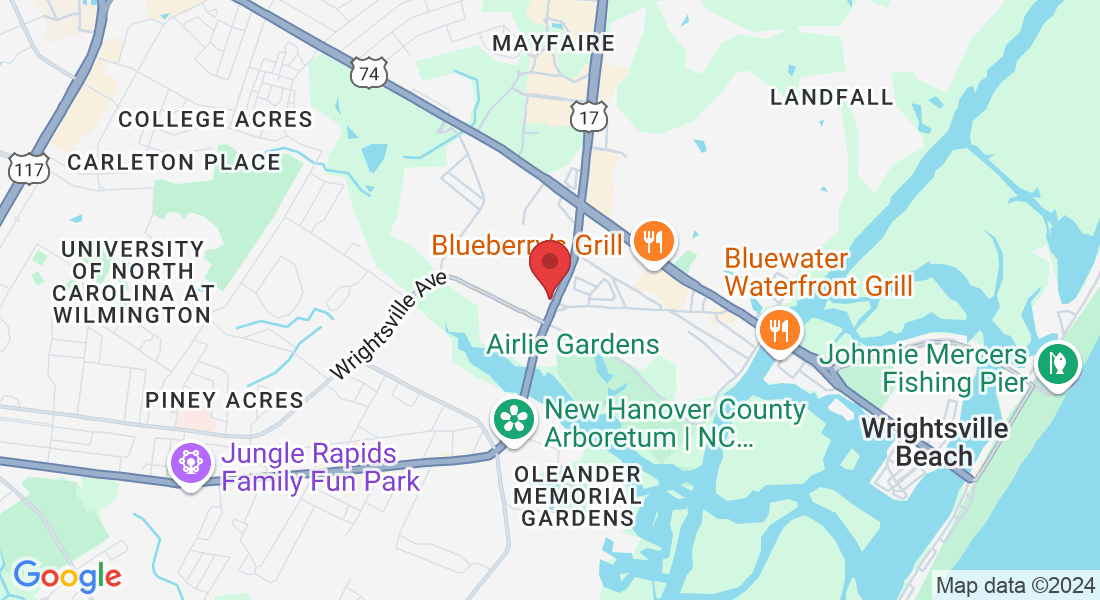

At All Things Home & Auto, we specialize in assisting homeowners in North Carolina to find the optimal coverage at affordable rates. Whether it's safeguarding your home against natural disasters or protecting your possessions from unexpected mishaps, we prioritize your peace of mind. With our personalized approach and commitment to exceptional service, we strive to be your trusted partner in securing the best insurance solutions for your home in North Carolina.

Here are some common scenarios where home insurance may provide coverage

Fire: If your home is damaged or destroyed by a fire, your home insurance policy typically covers the cost of repairs or rebuilding.

Windstorm/Hail: Damage caused by windstorms or hail, such as roof damage or broken windows, is usually covered by home insurance.

Theft: If your personal belongings are stolen during a burglary or theft, your home insurance policy can reimburse you for the value of the stolen items.

Vandalism: Damage to your home or property caused by vandalism is typically covered by home insurance.

Water Damage: Home insurance may cover water damage resulting from sudden and accidental events, such as burst pipes, plumbing leaks, or appliance malfunctions.

Falling Objects: Damage caused by falling objects, such as trees or branches, is generally covered by home insurance.

Explosion: If your home is damaged by an explosion, whether due to a gas leak or other causes, your home insurance policy may provide coverage for repairs or rebuilding.

Smoke Damage: Home insurance may cover damage caused by smoke, such as from a fire in a neighboring property or a malfunctioning appliance.

Damage from Vehicles: If your home is damaged by a vehicle, such as a car crashing into your house, your home insurance policy typically provides coverage for repairs.

Civil Unrest/Riots: Damage to your home or property resulting from civil unrest or riots may be covered by home insurance.

It's important to review your home insurance policy carefully to understand the specific covered perils and any exclusions. Additionally, certain natural disasters, such as floods and earthquakes, are typically not covered by standard home insurance policies and may require separate coverage or endorsements.

FAQS

What does homeowners insurance typically cover?

Homeowners insurance typically covers a range of risks and liabilities. It generally includes coverage for damage to your dwelling, other structures on your property (like a detached garage), personal belongings, liability protection in case someone is injured on your property, and additional living expenses if your home becomes uninhabitable due to a covered event. However, specific coverage can vary depending on your policy, so it's essential to review your policy documents and discuss your needs with your insurance agent to ensure you have the right coverage for your situation.

Can I make changes to my homeowners insurance policy mid-term?

Yes, you can usually make changes to your homeowners insurance policy mid-term. Common mid-term changes include updating your coverage limits, adding or removing endorsements, and changing your deductible. However, it's essential to contact your insurance provider to discuss any changes and understand how they might affect your premium. Keep in mind that certain changes may require underwriting approval, and some could result in adjustments to your policy premium.

What factors affect my auto insurance premiums?

Several factors influence auto insurance premiums, including your age, gender, driving record, type of vehicle, location, credit score, coverage limits, deductibles, and any discounts you may qualify for.

What is liability coverage, and why do I need it?

Liability coverage helps pay for damages and injuries you may cause to others in an accident for which you are at fault. It is required by law in most states and is essential for protecting your assets in case of a lawsuit. Fun Fact, North Carolina will be increase the minimum Liability limits starting

January 01, 2025