We are committed to making insurance hassle-free and convenient. Our mission is to simplify the entire process so that you can focus on what truly matters in life.

About us

Our commitment to exceptional customer service drives us to prioritize effective communication and transparency. We believe in keeping our clients informed and empowered throughout the insurance process. Our team takes immense pride in our ability to deliver comprehensive coverage at affordable prices. Trust us to protect what matters most to you.

Meet our Team

Shawn Montren

Owner

Meet Shawn Montren,

Owner of All Things Home and Auto Insurance

A graduate of Barton College, where he excelled both academically and athletically. As a former college baseball player, Shawn understands the value of teamwork, strategy, and dedication. He takes the same approach to insurance as he did on the field, tirelessly advocating for his clients and ensuring they receive the best possible coverage.

Off the field, Shawn is a devoted baseball fan, and his passion for the sport permeates his work ethic and commitment to excellence.

When he's not crafting insurance solutions, you can find him enjoying the great outdoors or hitting the gym.

Shawn is also happily married to his beautiful wife, Peyton, who shares his love for adventure and supports him in both his personal and professional endeavors.

Whether you're safeguarding your home or protecting your vehicle, you can trust Shawn to go to bat for you, delivering personalized service and peace of mind every step of the way.

FAQS

What does homeowners insurance typically cover?

Homeowners insurance typically covers a range of risks and liabilities. It generally includes coverage for damage to your dwelling, other structures on your property (like a detached garage), personal belongings, liability protection in case someone is injured on your property, and additional living expenses if your home becomes uninhabitable due to a covered event. However, specific coverage can vary depending on your policy, so it's essential to review your policy documents and discuss your needs with your insurance agent to ensure you have the right coverage for your situation.

Can I make changes to my homeowners insurance policy mid-term?

Yes, you can usually make changes to your homeowners insurance policy mid-term. Common mid-term changes include updating your coverage limits, adding or removing endorsements, and changing your deductible. However, it's essential to contact your insurance provider to discuss any changes and understand how they might affect your premium. Keep in mind that certain changes may require underwriting approval, and some could result in adjustments to your policy premium.

What factors affect my auto insurance premiums?

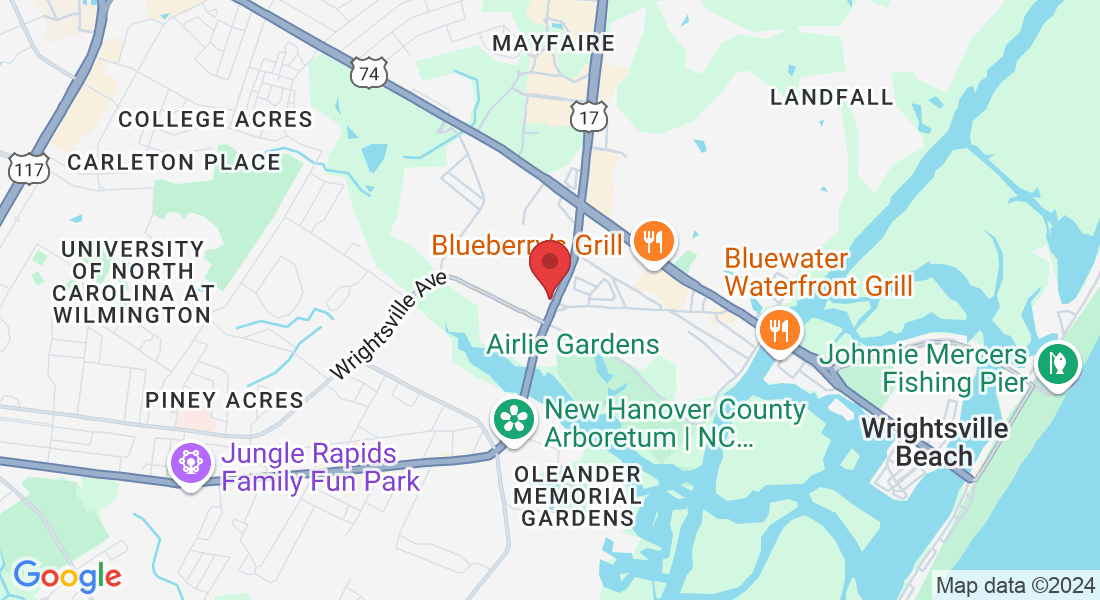

Several factors influence auto insurance premiums, including your age, gender, driving record, type of vehicle, location, credit score, coverage limits, deductibles, and any discounts you may qualify for.

What is liability coverage, and why do I need it?

Liability coverage helps pay for damages and injuries you may cause to others in an accident for which you are at fault. It is required by law in most states and is essential for protecting your assets in case of a lawsuit. Fun Fact, North Carolina will be increase the minimum Liability limits starting

January 01, 2025