Running a successful business requires careful planning and risk management. At All Things Home & Auto, we understand the unique challenges faced by business owners, which is why we offer a wide range of insurance solutions tailored to your specific needs.

General Liability: Safeguard your business against claims of bodily injury, property damage, and personal injury with comprehensive general liability coverage.

Workers' Compensation: Protect your employees and your business from the financial consequences of workplace injuries or illnesses with workers' compensation coverage.

Professional Liability Insurance: Shield your business from claims of negligence or errors with professional liability insurance, also known as errors and omissions (E&O) coverage.

Commercial Property Insurance: Ensure your business property, including buildings, equipment, and inventory, is protected against loss or damage from fire, theft, vandalism, and more.

Business Interruption Insurance: Keep your business afloat in the event of a temporary shutdown due to a covered peril, such as a fire or natural disaster, with business interruption insurance.

FAQS

What does homeowners insurance typically cover?

Homeowners insurance typically covers a range of risks and liabilities. It generally includes coverage for damage to your dwelling, other structures on your property (like a detached garage), personal belongings, liability protection in case someone is injured on your property, and additional living expenses if your home becomes uninhabitable due to a covered event. However, specific coverage can vary depending on your policy, so it's essential to review your policy documents and discuss your needs with your insurance agent to ensure you have the right coverage for your situation.

Can I make changes to my homeowners insurance policy mid-term?

Yes, you can usually make changes to your homeowners insurance policy mid-term. Common mid-term changes include updating your coverage limits, adding or removing endorsements, and changing your deductible. However, it's essential to contact your insurance provider to discuss any changes and understand how they might affect your premium. Keep in mind that certain changes may require underwriting approval, and some could result in adjustments to your policy premium.

What factors affect my auto insurance premiums?

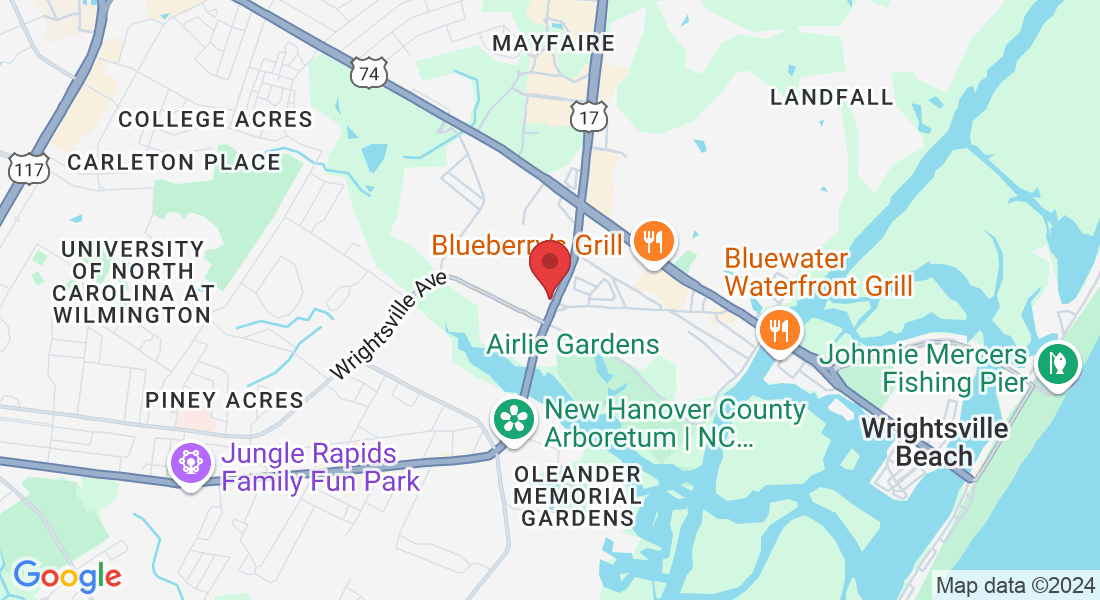

Several factors influence auto insurance premiums, including your age, gender, driving record, type of vehicle, location, credit score, coverage limits, deductibles, and any discounts you may qualify for.

What is liability coverage, and why do I need it?

Liability coverage helps pay for damages and injuries you may cause to others in an accident for which you are at fault. It is required by law in most states and is essential for protecting your assets in case of a lawsuit. Fun Fact, North Carolina will be increase the minimum Liability limits starting

January 01, 2025