Find the best rate for all your Auto Insurance needs.

Call and save on your auto coverage

Saving money on auto insurance is possible for everyone, no matter their driving record or the type of vehicle they drive.

There are several ways to achieve this. First and foremost, comparing quotes from different insurance providers is crucial. This allows you to find the best rates and coverage options that suit your needs. Additionally, maintaining a clean driving record and avoiding accidents or traffic violations can help reduce your insurance premiums. Another way to save money is by taking advantage of discounts offered by insurance companies. These discounts may include multi-policy discounts, Image safe driver discounts, or discounts for installing safety features in your vehicle.

Finally, opting for a higher deductible can also lower your insurance costs. By following these strategies, you can save money on auto insurance without compromising on coverage.

Affordable coverage for every situation

Saving money is indeed crucial, but we understand the importance of not sacrificing coverage or quality. That's why we have partnered with some of the highest-rated companies in the country. By working with these reputable companies, we ensure that you have access to policies that meet your requirements while still being cost-effective. We prioritize both your budget and your peace of mind. With our trusted partners, you can confidently save money without compromising on the coverage or quality you deserve.

Liability/Bodily Injury

Property Damage

Comprehensive

Collision

Medical Payments

Uninsured/underinsured Motorist

Rental Car/Towing

Standard & Safe Driving Discounts

Non Owners Policy

DWI & DUI Insurance

Tickets & Traffic Violations

Inexperienced Drivers

Commercial Auto policies

FAQS

What does homeowners insurance typically cover?

Homeowners insurance typically covers a range of risks and liabilities. It generally includes coverage for damage to your dwelling, other structures on your property (like a detached garage), personal belongings, liability protection in case someone is injured on your property, and additional living expenses if your home becomes uninhabitable due to a covered event. However, specific coverage can vary depending on your policy, so it's essential to review your policy documents and discuss your needs with your insurance agent to ensure you have the right coverage for your situation.

Can I make changes to my homeowners insurance policy mid-term?

Yes, you can usually make changes to your homeowners insurance policy mid-term. Common mid-term changes include updating your coverage limits, adding or removing endorsements, and changing your deductible. However, it's essential to contact your insurance provider to discuss any changes and understand how they might affect your premium. Keep in mind that certain changes may require underwriting approval, and some could result in adjustments to your policy premium.

What factors affect my auto insurance premiums?

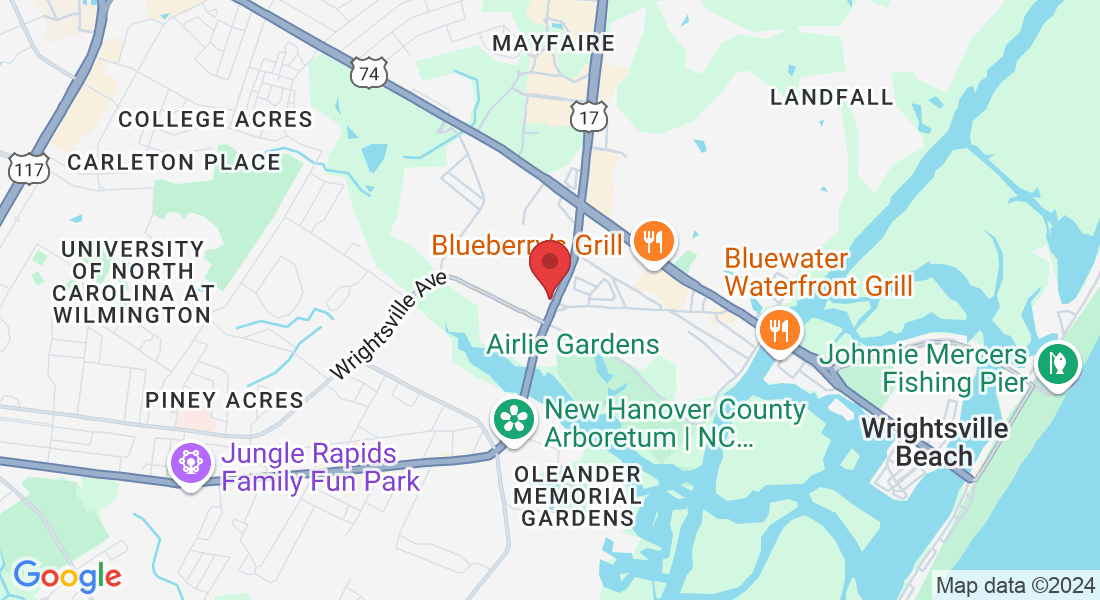

Several factors influence auto insurance premiums, including your age, gender, driving record, type of vehicle, location, credit score, coverage limits, deductibles, and any discounts you may qualify for.

What is liability coverage, and why do I need it?

Liability coverage helps pay for damages and injuries you may cause to others in an accident for which you are at fault. It is required by law in most states and is essential for protecting your assets in case of a lawsuit. Fun Fact, North Carolina will be increase the minimum Liability limits starting

January 01, 2025